Many lenders required the borrower to have at least 15% to 20% equity in their house. Need Significant Equity - Homeowners will need significant equity in their house to qualify for a HELOC. May Lose Your Home - If at some point you can no longer afford to repay the HELOC, you may lose your house.

However, just because you can use the money to do whatever doesn't mean it is a good idea to use a HELOC for a vacation because you are putting your house on the line. You can use a HELOC to renovate your house, fund a college education, pay off credit card debt, or do anything you can think of. Use the Money for Anything - You can use the money that you get from a HELOC loan for anything you like. Low Costs - a HELOC loan has no or very low closing costs and fees. Large Loan Amount - Depending on the equity in your home, borrowers may qualify for a large loan amount compared to other types of loans.įlexible Payment Options - You can make minimum interest payments during the draw period or pay off the HELOC anytime if you like. Lower Interest Rate - The interest rate for a HELOC is much lower than any other loan that you may get, be it a personal loan, car loan, or credit card loan. He needs to start making a monthly payment to repay the loan which is like a regular loan where the borrower is required to make principal and interest payments until the loan is paid off.Īs with anything else in life, there are pros and cons of a HELOC loan, following are the main benefits and drawbacks. The borrower is not required to pay off the whole balance, he can make monthly payments to reduce the amount owed or make interest-only payments.Ī HELOC has two phases, a draw period and a repayment period.ĭuring the draw period which usually lasts 10 years, the borrower can borrow as much as he can up to the credit limit, and he is allowed to make interest-only payments during the draw period.Īfter the draw period is over, the borrower is no longer able to borrow or draw from his HELOC loan. Once he pays off the $30,000, the credit limit goes up to $100,000. After he used $30,000, he can still use up to $70,000. The interest is charged based on how much the homeowner uses, not the whole credit limit.įor example, if a borrower is given $100,000 for a HELOC, and he uses $30,000, he is only required to pay interest on the $30,000 used. Once approved, the borrower is given a limit on how much they can borrow or use. Some lenders may take more risk and go for 90% while others may take the conservative route and go for 80% max.Ī HELOC loan works like a credit card. In general, borrowers can borrow up to 85% of their home equities. The more equity you have, the more you can borrow.

The amount that you can borrow depends on the equity you have in your home.

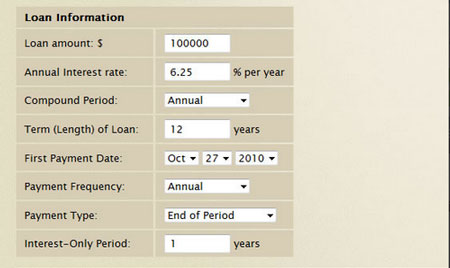

The home equity line of credit amortization schedule calculate the principal and interest payment each month.Ī home equity line of credit or HELOC is a loan that uses your home as collateral. The home equity line of credit calculator will calculate the costs of the loan and the total interest payment when the loan is paid off.

0 kommentar(er)

0 kommentar(er)